Startups Stack Exchange Archive

Are we in a tech bubble now?

- posted by: Esqarrouth on 2014-12-28

- tagged:

tech-company,valuation - score: 2

A period of significant increase in the stock market due to a rise in speculation of technology stocks. Such stocks in the bubble may be categorized in one particular industry or encompass an entire sector of technology depending on investor demand. Investors start considering the potential for a huge profit opportunity and then proceed to purchase stocks that they would not typically consider. During this time, new technology companies will look to go public through initial public offers to capitalize on the demands of investor interest. An example of a tech bubble was the dot com boom in 1999 and subsequent collapse in 2000.

Read more: http://www.investorwords.com/11778/tech_bubble.html#ixzz3NDCAz9iS

There has been a lot of debate about if we are in a tech bubble at the moment or not. On one side a lot of the old classic industries are integrating with technology. On the other side everyday month new web/mobile startups worth billions of dollars emerging.

Are we in another bubble?

Answer 1902

- posted by: blunders on 2015-01-06

- score: 2

No, there's currently no tech bubble.

To get a small idea of how insane the dot-com bubble was take a look at this chart of venture capital investments in billions from 1985 to 2013:

Answer 1898

- posted by: Tobias Simmel on 2015-01-06

- score: 1

I don´t think you can compare the situation we are in with the ´99/´00 bubble.

Eventhough 2014 is missing in this chart, you can see the huge gap in tech IPOs between 99/00 and now. One reason for this situation is that it is extremely easy for tech companies to tap private markets (see Uber´s Goldman deal) and there is simply no need to raise money via an IPO.

Most of the time, IPOs are only used to give existing shareholders (founders, VCs etc.) the opportunity to cash out.

Answer 1901

- posted by: Denis de Bernardy on 2015-01-06

- score: 0

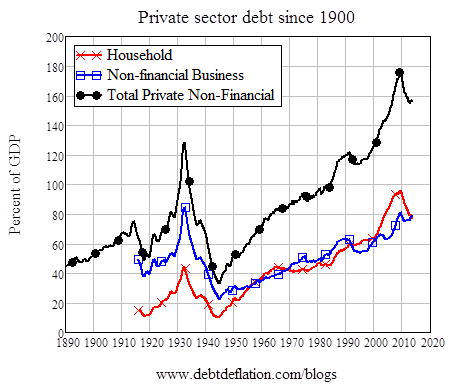

We’ve technically been in a bubble for the past 30 years or so if you look at the debt:gdp ratio. The 2000 and 2008 crisis were mere hiccups in the bigger picture.

Here’s a chart for the US compiled by Steve Keen:

(Note that this is private non-financial debt, i.e. it’s minus Wall Street. Public debt is smaller, and financial debt is larger.)

These lectures on behavioral finance, by the same author, are pretty good if you’ve some time:

http://www.debtdeflation.com/blogs/lectures/

Now, as to whether tech sector itself is in a bubble, well… sure, but hey, everything else is in a bubble as well. Is tech more in a bubble than other sectors? Probably, if P/E ratios are an indicator. Does it really matter whether it is more so or not? Probably not, seeing the underlying fundamentals.

All content is licensed under CC BY-SA 3.0.